Top Cryptocurrency Trends For 2022-2025

- ADVISOR B&M

- Dec 24, 2021

- 9 min read

Updated: Feb 21, 2022

The cryptocurrency world took off last year.

The total market capitalization of all cryptocurrencies now exceeds $1.6 trillion.

And it’s estimated that there are over 300 million crypto users worldwide.

In this new report we'll share the biggest trends in the crypto space happening right now (in 2022). And those that are likely to continue through 2025 and beyond.

1. Institutional Adoption Of The Crypto Ecosystem

Financial institutions and large corporations have traditionally viewed the cryptocurrency ecosystem with skepticism.

Today, many institutions are actively allocating capital to this area.

Nowhere has this become more apparent than the asset management industry.

By the end of 2020, $15 billion of institutional assets under management had been allocated to the crypto asset class.

After years of hand wringing, large scale funds are going all-in with crypto.

This is compared to just over $2 billion at the end of 2019 (a 5x increase).

In addition, the Grayscale Bitcoin Trust (the only way for many institutions to obtain bitcoin exposure) saw assets increase by 900% in 2020.

The Grayscale Bitcoin Trust has seen search interest increase by 200% over the last five years.

While this amount is still peanuts compared to the overall asset management industry, future regulatory clarity could help in bolstering this number.

(More on that later.)

Until then, companies like MassMutual are helping to ease the transition.

The 169-year old insurer invested $100 million into bitcoin in 2020.

MassMutual made headlines by putting $100M of their funds into BTC.

In addition, Square and MicroStrategy somewhat shocked the business world by placing portions of their cash reserves in bitcoin.

One major reason for this change?

Large financial gatekeepers are making it easier for consumers to transact in cryptocurrencies.

PayPal data showed that users who bought crypto on the Paypal app logged in twice as much as they did before Paypal allowed such transactions.

Further, the Chicago Mercantile Exchange (CME) introduced Micro Ether future contracts in December 2021.

Coindesk has also noted that the number of "bitcoin whales" (addresses that own over 1,000 bitcoin) has been increasing rapidly since the end of 2020.

2. DeFi Powers More Use Cases

Almost nothing has drawn more attention in the crypto community last year than the advent of DeFi (Decentralized Finance) applications.

Search interest in "Decentralized Finance" has risen by 5,600% since 2017.

The concept basically involves traditional financial transactions that take place on the blockchain.

These transactions are typically enabled by the use of smart contracts.

And, unlike traditional payments or transfers, they avoid the need for financial intermediaries altogether.

DeFi transactions usually range from traditional lending to the creation of derivatives.

And growth in the DeFi space is only just beginning.

DeFi Pulse reports that the Total Value Locked (TVL) – a measure of the total value of cryptocurrencies that are committed to a smart DeFi contract – grew from $2 billion to $15 billion in 2020.

And 2021 has brought unprecedented growth. Since the beginning of last year, the TVL more than doubled to just under $100 billion.

One of the most popular recent DeFi applications has been yield farming.

Yield farming involves lending crypto assets to other platforms in return for interest or new cryptocurrencies.

Searches for "yield farming" have grown by 942% over the last five years.

On the surface, yield farming very is similar to digital banking.

Users deposit their crypto assets in a pool of funds and receive interest on those assets.

In many cases the depositor is staking a new crypto platform.

And will receive a new crypto asset in return for the liquidity he or she provides.

In our low interest rate environment, yield farming platforms have received notable attention because of the higher rates they can offer to depositors.

Compound is probably the largest yield farming DeFi platform.

Compound is a leading interest rate protocol.

It allows users to deposit cryptocurrencies into a pool, receiving in return a redeemable token that represents a stake in that pool.

Compound is basically acting as a central clearing house for crypto-based lending.

The total amount supplied on the platform is currently over $10 billion. And the total amount borrowed is at roughly $4 billion.

In addition, platforms like Crypto.com are meshing the worlds of traditional finance services and DeFi.

Searches for "Crypto.com" have increased by 6,400% over the last five years.

The platform allows users to place cryptocurrencies in a digital wallet, exchange cryptocurrencies, yield farm, and seamlessly pay with credit cards like Visa using cryptocurrencies that users have in their wallet.

Decentralized exchanges (DEXs) have also proven popular over the last year.

Search growth for the term "Decentralized exchange" has risen by 315% over the last 2 years.

DEXs allow crypto owners to transact directly, without the need for an intermediary.

They also give users complete ownership and control of their crypto assets.

Monthly trading volume on DEXs is rising rapidly.

January 2021’s monthly trading volume was $56 billion, an increase of over 1,000% from 2020’s high of $26 billion in September.

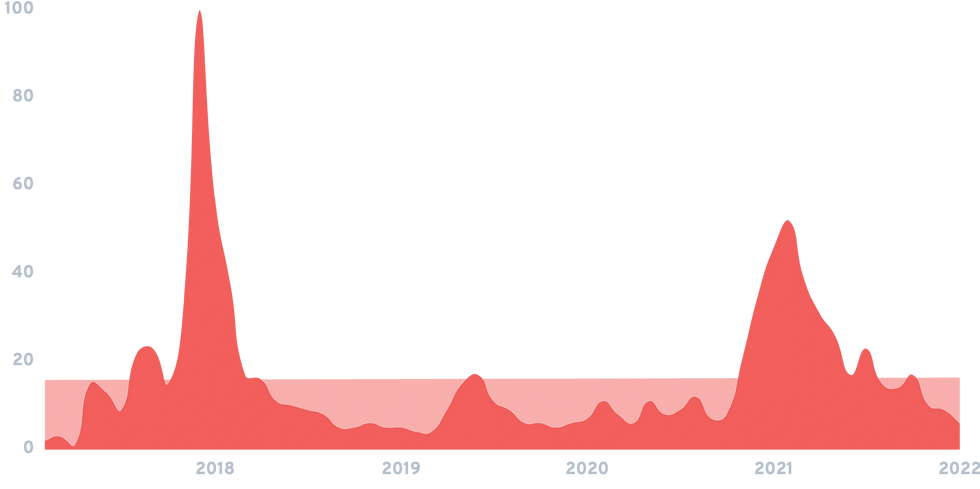

Monthly trading volume on DEXs since 2019.

The majority of the volume is captured by the two largest decentralized crypto exchanges: Uniswap and Sushiwap.

Uniswap is a decentralized trading protocal for Ethereum.

It provides liquidity to the large collection of DeFi applications that are native to the Ethereum blockchain.

With just over 50% of total trading volume for all DEX platforms, Uniswap is the undisputed market leader.

However, SushiSwap, a fork of the Uniswap DEX, is starting to encroach on the larger exchange’s territory.

SushiSwap exchange captured 23% of total monthly trading volume in January 2021.

Search interest in "SushiSwap" has increased by 87% over the last year.

What’s more impressive than its current position, however, is SushiSwap’s rapid growth.

Just last year, it held only 1.98% of the total DEX volume market share.

3. NFTs Tokenize Everything

One of the most interesting developments in the crypto space is the rise of non-fungible tokens (NFTs).

Search interest in "non-fungible tokens" has grown by 99x+ over the last five years.

These tokens basically represent digital claims to a unique thing or asset.

The item they represent can be digital or physical.

NFTs went relatively mainstream in 2021. And are likely to remain a large part of the crypto landscape moving forward.

Fungible tokens – like bitcoin – do not necessarily represent any claim to an asset or physical thing.

They can be traded and divided into smaller pieces.

NFTs, on the other hand, represent claims to things like domain names, physical or digital artwork, collectibles, and video game add-ons.

Typically created on the ETH blockchain, most NFTs have imbedded smart contracts that describe the digital or physical product they represent.

And, for the most part, they are not divisible like fungible tokens (though that is changing).

Because of the fragmented nature of this market, it is difficult to estimate the total size.

But we can get a general idea by looking at individual NFT platforms.

Some estimates have placed monthly NFT trading volume at around $15 million in October 2021.

That number is likely to grow, however, as the market value Ethereum’s NFT sector grew to $33 million from $3 million just in the month of January.

And DappRadar reported that weekly trading volume for the five largest Ethereum NFT marketplaces grew to $2.7 million in the week of January 19, 2021.

The general idea was popularized by marketplaces like CryptoKitties and CryptoPunks.

The two tokens offered ownership in collectibles like digitally-rendered cats and pixelated artwork.

Searches for "cryptopunks" have seen 8,000% growth in two years.

As strange as it sounds, the CryptoKitties concept represented the first viable use case for NFTs.

It’s even estimated that over $40 million has changed hands in the CryptoKitties ecosystem, with some tokens selling for around $300,000.

One cryptopunk even recently sold for over $762,000.

More practical use cases have come along since then, though.

In the art world, NFT adoption is definitely on the rise.

Companies like SuperRare were selling over $4 million a month in tokenized artwork by the end of 2020.

In fact, NFT technology is solving ownership and copyright issues that have long plagued the art community.

Platforms like AsyncArt are allowing artists to collect royalties on future, secondary sales of artwork they create.

AsyncArt is a popular way to put "art on the blockchain".

Even the large art auction houses are jumping on board now.

In October of 2020, Christie’s auctioned off an NFT-linked physical portrait of the Bitcoin code for $130,000.

How about another example?

NBA Top Shot, a popular NFT marketplace, deals in professional basketball collectibles.

It allows fans to buy and sell digital video highlights of their favorite players.

Search interest in "NBA Top Shot" has risen more than 1,100% over the last couple of years.

The new NFT marketplace has blown past competitors, generating over $30 million in sales volume in the month of January 2021.

For comparison, CryptoPunks, which is the second largest NFT marketplace, sold just $4.9 million over the same period.

4. Regulation Is Unavoidable

2021 was the year of increasing regulatory clarity in the crypto market.

The 2017 ICO craze ushered in an era of increasing government scrutiny.

And legal questions over the nature of cryptocurrencies themselves have continued to confound regulators.

The Ripple case illustrates this trend well.

In late 2020, the Securities and Exchange Commission (SEC) brought a case against Ripple Labs alleging the company offered approximately $1.3 billion in unregistered securities when it sold much of its XRP cryptocurrency to the public.

Ripple Labs was under SEC investigation for almost a year. Putting their XRP coin in jeopardy.

This obviously calls into question certain parts of the crypto market. And it is still unclear what's considered a "security" and "commodity" in the digital world.

The Commodity Futures Trading Commission (CFTC) also brought a civil enforcement action against notable cryptocurrency exchange BitMEX.

The complaint alleges that BitMEX operates an unregistered trading platform and flouts CFTC regulations like the implementation of anti-money laundering procedures.

In the financial markets arena, many hoped that 2021 would herald the introduction of the first cryptocurrency ETF.

As recently as October of 2020 the SEC has said that it is actively working on regulations that will allow for the marketing and trading of cryptocurrency ETFs.

However statements by former SEC officials and crypto experts repeatedly dash the hopes of near-term regulatory changes.

The Office of the Comptroller of the Currency (OCC), which was previously run by the former general counsel for Coinbase, took some innovative steps during the last year as well.

Among them was enabling financial institutions to serve as custodians for their clients’ crypto assets.

The President’s Working Group on Financial Markets also released a statement on stablecoins and is further investigating the concept.

5. The Market For DApps Expands

Decentralized Applications (or DApps) are software applications that run on a distributed peer-to-peer network.

Searches for "decentralized application" are up 369% in five years.

The potential market for decentralized applications is huge.

DAppRadar estimates that total DApp transaction volume increased to $271 billion in 2020 (up from $21 billion in 2019.)

Many DApps run on the Ethereum blockchain and perform some kind of DeFi functionality.

In fact, DAppRadar found that roughly 45% of new DeFi DApps were run on the Ethereum blockchain.

Transaction volume is even more geared towards the Ethereum ecosystem.

95% of DApp transaction volume takes place on DeFi Ethereum applications.

Recent estimates indicate that roughly 2000 DApps are operating on the Ethereum blockchain.

Many of the most popular Ethereum-based DApps consist of applications covered above, like Uniswap and SuperRare.

Outside of Ethereum, platforms like EOS and TRON are also gaining traction.

The two platforms are in second place, with an estimated 750 DApps in their ecosystems.

While not yet at the size of Ethereum, EOS addresses many of the problems that come with creating DApps on the Ethereum blockchain.

By getting rid of transaction fees and enabling millions of transactions per second, EOS has been able to achieve significantly more scale than other decentralized DApp platforms.

On the EOS blockchain, games like Upland are rapidly growing.

Upland is a metaverse build on the EOS blockchain.

The metaverse style property trading game allows users to buy and sell virtual property that is mapped to real-world addresses.

The number of new Upland users has increased by roughly 80% in the last 30 days.

6. Stablecoins And CBDCs Alter The Crypto Ecosystem

Although the most prominent stablecoin, Tether, is facing its own legal problems, the stablecoin concept is still rapidly gaining momentum.

Searches for "Tether" have increased by 828% in five years.

The total market value of stablecoins is estimated to be over $157 billion.

Admittedly, about half of this market is made up of Tether.

But this does not mean growth cannot come from other places.

Many times, stablecoins are used in DeFi applications because of their relative price stability.

If someone needs to enter into some kind of decentralized transaction, they don’t want the value of their capital to decrease because of momentary volatility.

Searches for "stablecoins" have grown by 8,400% since 2017.

On the other side of the coin, central banks are trying to get ahead of the curve by issuing their own digital currencies.

Many feel the proliferation of stablecoins could usher in an era of unregulated speculation in unstable private currencies.

These tokens, called central bank digital currencies (CBDCs), are being looked into by at least 80% of central banks around the world.

Searches for "central bank digital currency" have grown by 2,225% over the last five years.

In the developed world, the U.K. was the first to announce such a project, but it has not been the last.

In 2020, the Bank of International Settlements (BIS) and seven major central banks announced a plan to work together on CBDCs that will be used for public policy efforts.

The People’s Bank of China (PBOC) is committed to being a worldwide leader in the adoption of cryptocurrency technology.

It has already completed two CBDC pilot programs.

The PBOC concluded its second trial by the end of 2020, and successfully issued 20 million digital yuan (roughly $3.1 million) to 100,000 Chinese residents in Suzhou.

China is looking to lead when it comes to issuing stablecoins.

In this second trial, users were able to make electronic payments using the digital currency without an internet connection.

Point of sale transactions were also completed without an intermediary and without charging fees.

Even the U.S. Federal Reserve is considering the creation of a digital dollar.

If CBDC adoption ever reaches fruition, this technology looks poised to disrupt the international payments market.

Conclusion

That concludes our list of the top crypto trends to watch right now.

The cryptocurrency market has been almost completely unpredictable over the last several years. Not only due to new innovations (like NFTs).

But also due to general market volatility with mainstream coins (like Polktadot and Litecoin) along with many alt coins (like Dogecoin).

One thing that is certain, however, is that innovation in this space will continue.

Comments